Fasanara x Glassnode

Q4 2025 Digital Assets Report

Get an authoritative in-depth perspective on the Q4 2025 digital asset landscape for institutional investors.

By submitting this form, you are agreeing to our T&Cs & Privacy Notice and for your information to be shared with Coinbase, Inc.

Brought to you by

A pioneering market-neutral fund focused on digital assets, Fasanara Digital uses its superior infrastructure to achieve exceptional risk-adjusted returns for institutional investors.

The industry’s leading blockchain data and intelligence platform empowers investors to excel in trading, research, and risk management. Trusted by the world’s top financial institutions.

Key Highlights

Below are some of the many takeaways from the report:

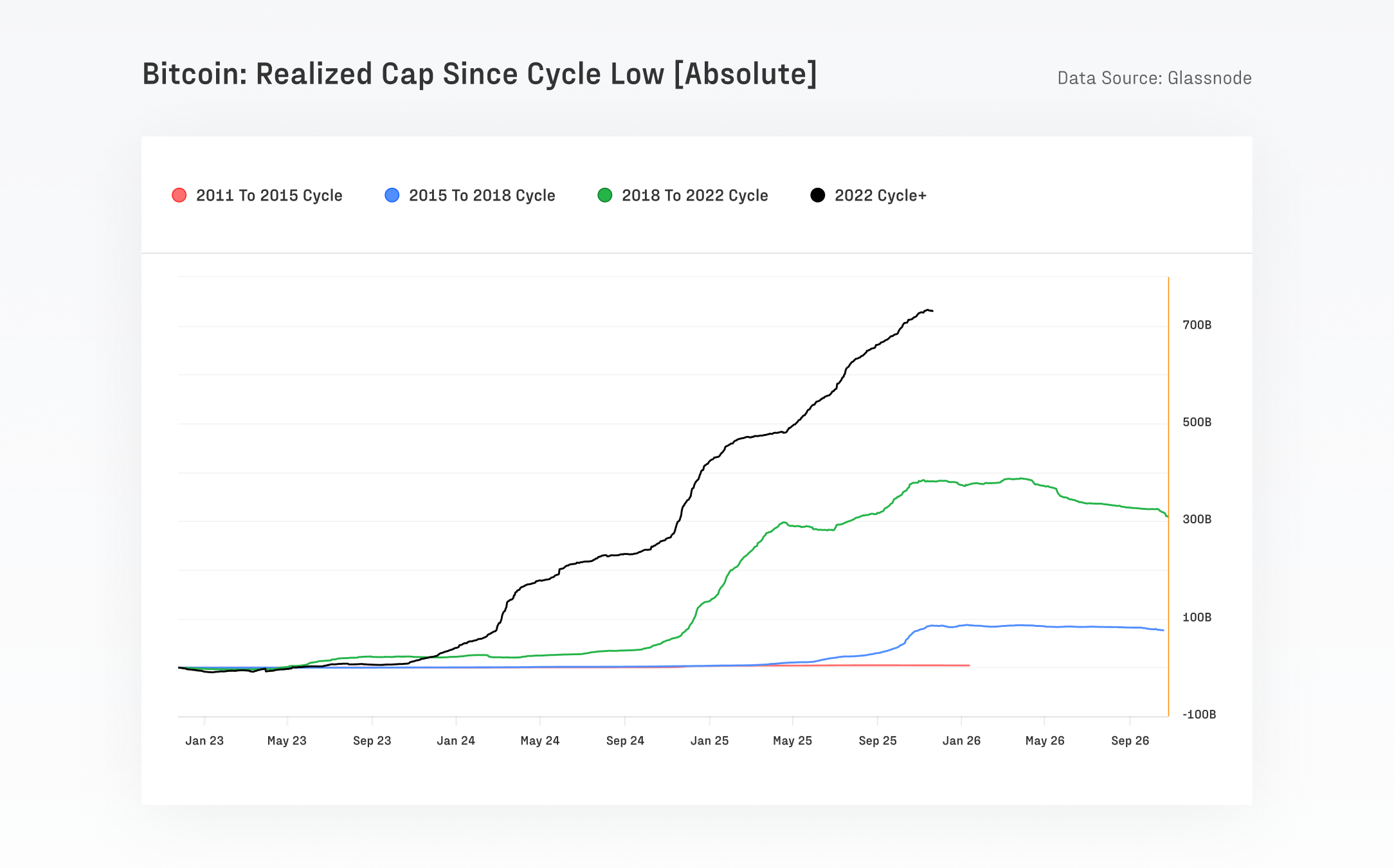

This cycle is Bitcoin-led, spot-driven, and institutionally anchored

Bitcoin attracted $732B in new capital this cycle — more than all prior cycles combined. Ethereum and the broader altcoin sector appreciated strongly too, peaking at over +350% gains, but did not outperform Bitcoin (+690%) as in prior cycles.

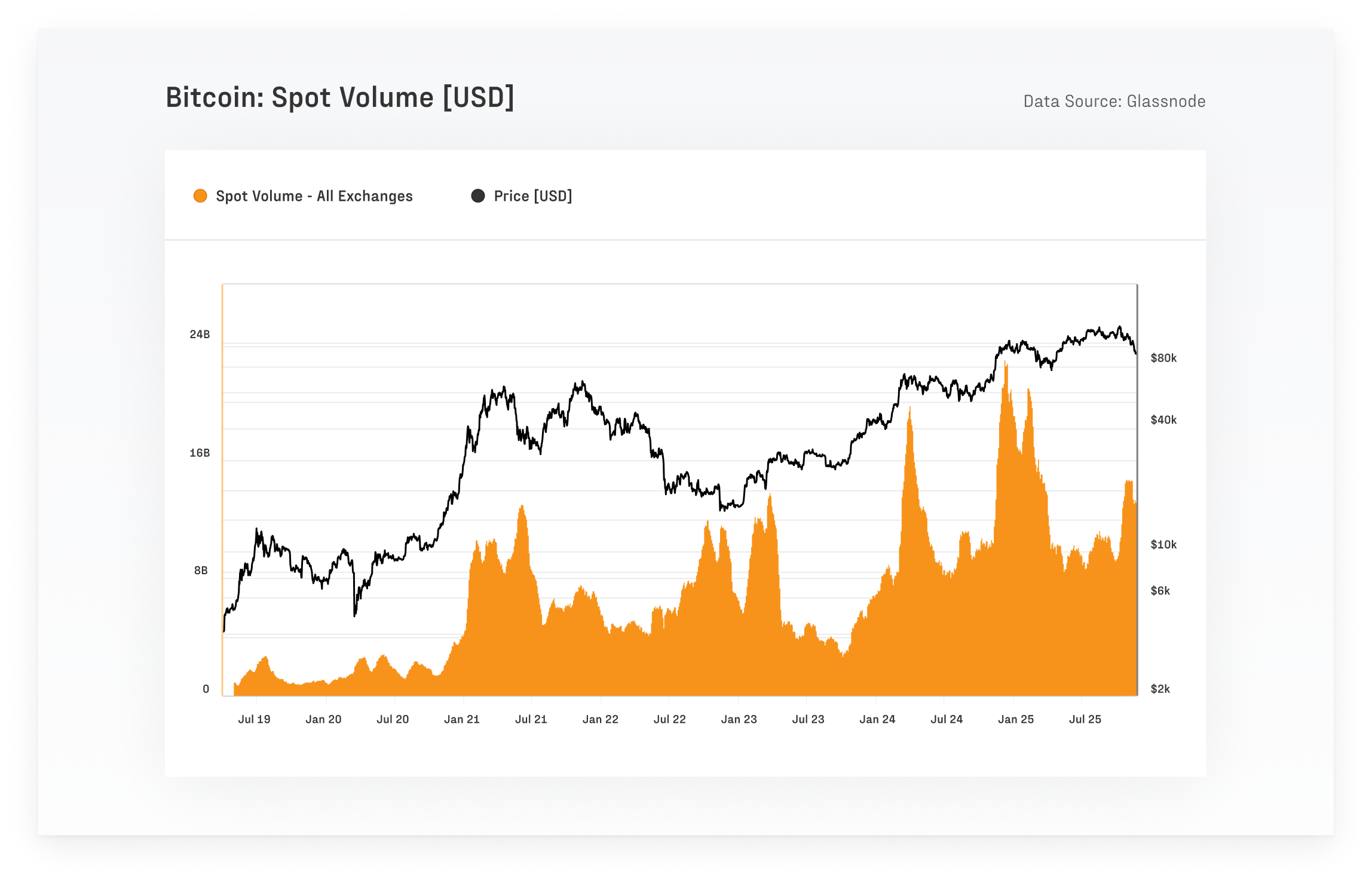

Market structure has matured – but leverage shocks still bite

Bitcoin spot volumes have scaled into the $8B–$22B range, reflecting deeper liquidity, just as one-year realized volatility has declined from 84.4% to 43.0%. However, average daily liquidations expanded to $68M long and $45M short.

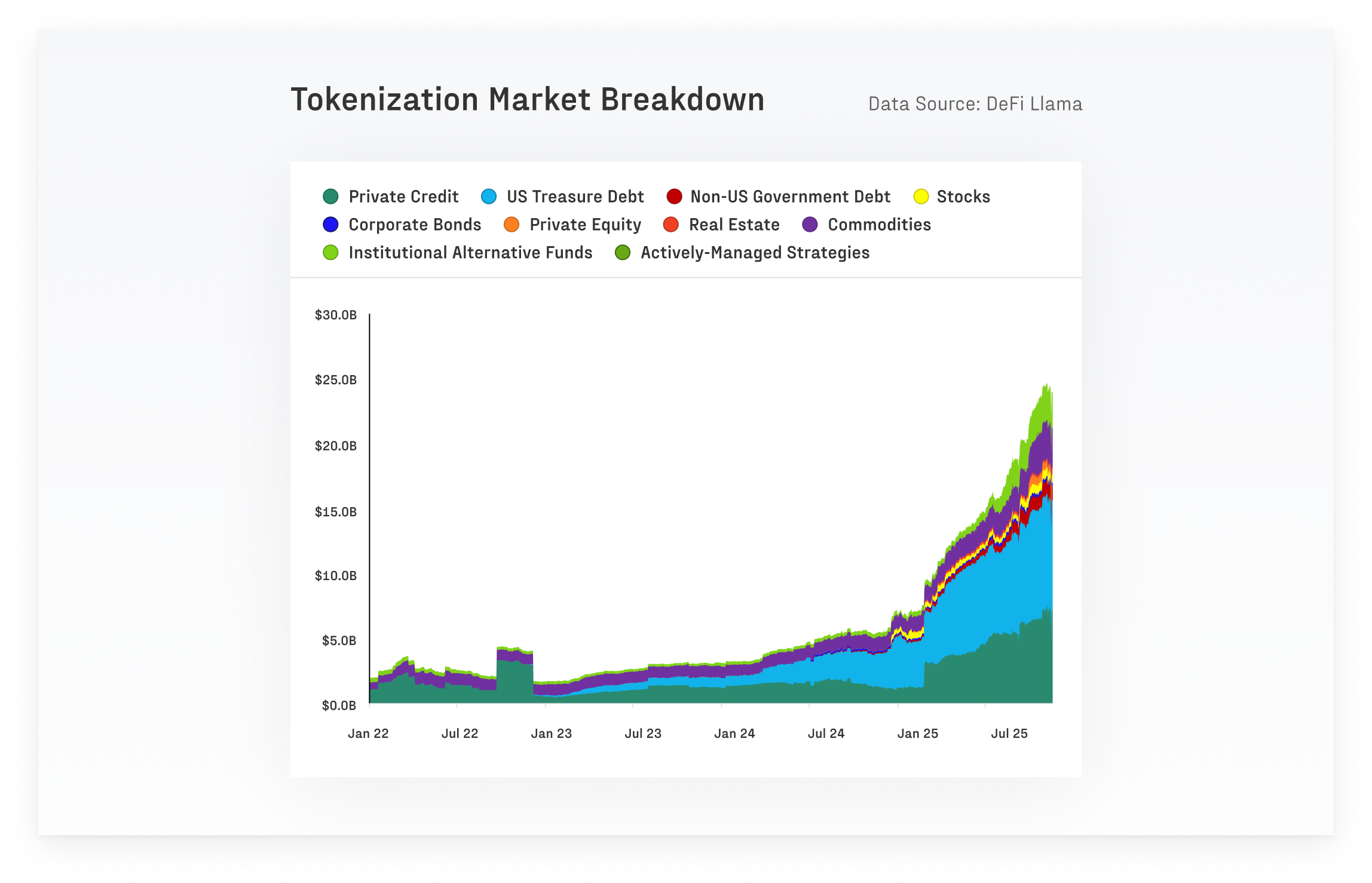

Tokenized assets are expanding the market’s financial rails

RWAs grew from $7B → $24B in a year. RWA collateral is low-correlation vs crypto assets, increasing stability and capital efficiency in DeFi. Tokenized funds are among the fastest-growing categories, opening new distribution channels for asset managers..

Execution and settlement infrastructure scaled under stress

DEX-perpetual share grew from ~10% → ~16% of perpetual volume, as monthly perpetual volume crossed $1T for the first time. During October's volatility, ClearLoop processed $1.8B in collateral movements and issued 70+ margin calls totaling over $1B. CEX spreads, especially in futures, have structurally compressed from 0.25% → 0.05%, still reacting to short-term price swings.

As seen on

Want to access our unified trading signals for the

digital asset markets?

digital asset markets?

Get in touch with Glassnode product experts today. We help you take the first step in leveraging on-chain data to maximize your outcomes.

© 2023 Glassnode, all rights reserved